Written by Prio Wealth’s Director of Financial Planning, Bill Dion, CFP®

and Prio Wealth Relationship Manager, Robert Devinney, CFP®

When you first enter the workforce, retirement may seem like an abstract idea—one to be considered in the distant future. Saving for retirement may be low on your list of personal priorities. However, a clear reason to start saving early is for flexibility later. For previous generations, retirement was an age-based milestone. For younger generations, retirement may more appropriately be defined as an ‘independence milestone.” In other words, retirement is simply a time at which you are no longer dependent on wages to comfortably meet your needs and your lifestyle.

Why Save Now?

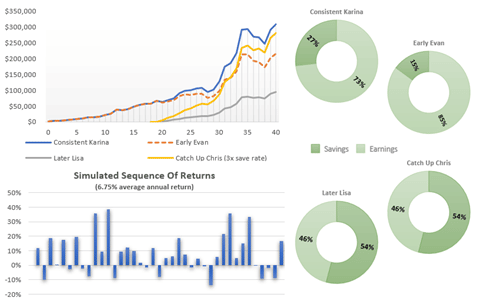

The earlier you save, the more time you have for compounding earnings to help boost your retirement savings. In the charts below, we provide four scenarios of retirement savers. Consistent Karina and Early Evan both start investing at the beginning of their career and contribute $100 per month to the employer-sponsored retirement plan. Karina continues to save and invest during her 40-year career, while Evan stops contributing after 20-years, yet keeps the savings invested. Later Lisa and Catch-Up Chris prefer to spend the $100 per month, and start to contribute to retirement savings later in the careers. In Lisa’s scenario, she begins saving and investing $100 per month in year 20, while Chris begins saving and investing three times this amount on a monthly basis (~$300/month).

As you can see from the line chart below, the power of saving early and compounding earnings is significant. Even though returns are volatile, and are even frequently negative, Karina and Evan are almost certain to have accumulated more wealth than their counterparts to put themselves in an advantageous retirement planning position. Meanwhile, Chris is reliant on compound ‘savings’ and is sacrificing a far bigger portion of future income to try to catch up. As for Lisa, she will be hard pressed to narrow the gap at all.

While it may be difficult to define what these numbers mean to you today, or how much you’ll need to have saved for retirement, the most deliberate action you can take today is to start saving. If you put off creating your retirement fund now, it becomes more difficult to do so with each passing year – and it can become costly to your financial health. Prioritizing your retirement savings and recognizing the power of compounding is a smart way to set yourself up for success during your accumulation years.

The Hierarchy of Retirement Savings

Most newly employed people may not consider themselves ‘investors’ but this is the time to start thinking like one. By now you know that you are supposed to be saving for retirement, but where do you start? First and foremost, every individual should have emergency savings consisting of enough cash to cover at least 3-6 months of expenses. This savings allocation should be your first priority to allow for some financial protection if something were to happen to your employment status or if an unexpected large expense arises. Separate from your emergency fund, we have described how you can begin to save a portion of your compensation for retirement to create long-term wealth.

Employer-Sponsored Retirement Plans

The first place to start saving for retirement is through an employer-sponsored retirement plan. This is usually a 401(k) but can also be presented as a 403(b) or some other type of plan. In many cases, your employer will match your contributions up to a specified percentage of your income. As you begin to save in an employer-sponsored plan, a good savings goal is to contribute at least as much as your employer is willing to match. It is important to prioritize this as the first vehicle for retirement saving, as you essentially getting “free” money or a retirement bonus!

If your employer offers a Roth – or after-tax – retirement savings option, it may be worth taking advantage of. By maximizing Roth savings now, you will not have to pay taxes on future withdrawals. Just like pre-tax retirement savings, Roth retirement savings grow tax free.

The downside to your employer-sponsored retirement plan is the limited availability of investment options. Most 401(k)s offer a handful of mutual funds or exchange-traded funds, but as you become familiar and comfortable with investing, you might want more options as your disposal. It’s also important to note that an individual’s maximum annual contribution to an employer retirement plan is $20,500 for 2022.

IRAs

A Traditional IRA or a Roth IRA are good investment vehicles if you are, 1) maximizing your 401(k) contributions and have excess cash to save, 2) if your employer does not offer a retirement savings plan, and 3) if you wish to have access to additional investment options such as individual stocks, ETFs, options, etc.

Opening, funding, and annually contributing to a Roth IRA may be worthwhile if your employer does not offer a Roth option as it will allow you to build after-tax savings. However, keep in mind there are income limitations associated with Roth contributions. In 2022, you may make a Roth contribution if your income is below $129,000 for single taxpayers and $204,000 for joint filers. A very important note: these income limits do not apply to contributions to an employer-sponsored Roth.

Taxable Accounts

If you find yourself in the position where you have made the maximum contributions to both your 401(k) and your IRA and there’s still money to save, it may be time to explore a taxable investment account. This type of savings account is non-retirement account, and typically allows the opportunity to invest across different types of securities like individual stocks, bonds, ETFs, options, etc. A taxable investment account is usually a good place to invest large sums of money received through year-end bonuses, inheritance, gifts, etc.

Keep in mind, these types of accounts are called taxable accounts for a reason. Any dividends, interest or capital gains generated within this type of account are taxable to you in the year in which they occurred. Despite the potential for taxation, a taxable account comes with a distinct advantage in that there are no retirement related restrictions. This type of account many be a great way for you to save and invest for a new home, graduate school, new car, take a vacation, etc.

Final Tips for Building your Retirement Fund

The type of account you choose to save in is less important than the decision to save in the first place, so just get started. The beauty of starting your savings sooner rather than later is that you have a chance to learn how you will react through up and down markets. As the simulation above shows, your investments will lose value from time to time and that’s ok. It is what you do during a down market that can make or break your portfolio. Your timeframe to retirement will help dictate your ability to stay invested during market corrections or even bear markets. It is imperative to stay invested when time is on your side. Studies have shown that those worst days tend to be directly followed by the market’s best days, and few people are savvy enough to time the market in such a way to take advantage of both.

Another important tip to building your retirement is to automate your savings. Whether it be through paycheck deductions or automatic transfers from your bank account into your savings or investment accounts, it’s a good idea to find a way to consistently save money during your accumulator years. By automating savings, you’ll be less likely to get in your own way of satisfying your retirement plan contributions.

For more information on retirement planning for accumulators, contact your Wealth Advisor at Prio Wealth.