by Kelley Ellis, Wealth Advisor at Prio Wealth

Our world has experienced a wide range of change, uncertainty and even opportunity during the past year. It’s natural for these events to impact our outlook in some way, as they present new types of risks and decisions. As many of us embrace the return to the “new normal,” we believe it is a great time to revisit or establish your asset allocation strategy and the financial plan by which it is supported.

(Re)Engage with an Advisor

Are you contemplating an earlier retirement, moving, engaging in a charitable endeavor, or helping out a child or grandchild? Are you facing a pending liquidity event either at work or within your family? It may be time to think through the financial decisions which could present themselves with these changes.

Prio Wealth believes financial decisions are more about life and less about money. This is why we have cultivated a series of proprietary client engagement tools that are at the core of our relationship with you and your family. Our client experience includes a uniquely structured conversation whereby we learn more about how you feel about money, and how to prioritize what matters most to you now and in the future. This highly collaborative process forms the foundation upon which we build clear and dynamic financial plans and advisory solutions. Perhaps most importantly, these results drive a customized asset allocation and investment strategy unique to you and your risk preferences, asset types, goals and priorities. Said another way: we help uncover what you are investing for.

Coordinate and Consolidate

The equity markets have been on a volatile ride over the past 15 months. Have you stepped back to put together a net worth statement to see how you have fared? Perhaps you switched jobs and need to consolidate retirement accounts, or you refinanced your home, or your daughter’s education needs have changed and you need to rethink her 529 savings plan. We take great pride in working with our clients to create and update a personal net worth statement which captures all their assets, liabilities, insurance policies, and even items beyond the balance sheet. If it’s been a while since you discussed your net worth statement with your advisor, now is a good time to dedicate the time and effort. It’s always surprising to see the ways you can consolidate accounts, repurpose an old trust, reconsider a dated asset allocation strategy, or even engage a favorable tax strategy. Let us help you put together and review your net worth statement so you can gain confidence and clarity in your financial affairs.

Rebalance and Refocus

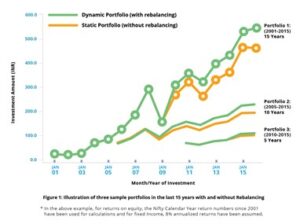

Asset allocation is the mix of various investment vehicles within your portfolio (e.g., stocks, bonds, cash, etc.). It is a key driver of how much risk you will take on for growth, so understanding how to leverage it effectively is essential. It is for this reason that investors recognize asset allocation as one of the most important components of a successful investment strategy.

Source: https://www.assetvantage.com/rebalancing-asset-allocation/

Maintaining your asset allocation targets is just as imperative as establishing the allocation strategy. This is why we believe that rebalancing is a core pillar of portfolio management. When a portfolio shifts away from its intended asset allocations due to market movement, we call it ‘portfolio drift.’ ‘Portfolio drift’ is addressed by rebalancing to keep you in line with your desired asset allocation. By rebalancing and refocusing your asset allocation, you are maintaining the desired risk level and exposure to various parts of the markets. It can also provide peace of mind knowing that you are managing risk to meet your priorities, goals, and obligations.

Stay in Touch

Whatever your stage of life, or your past or pending changes, an actively engaged financial advisory relationship will help you reach your goals more effectively, with more confidence and less stress. We’re here to meet you where you are, with different advisory strategies such as planning, charitable, tax, estate planning and gifting.

Please visit our website at www.priowealth.com to see our team and our differentiated approach to wealth management.

This document is for informational purposes only and should not be relied upon as an investment, tax or legal recommendation in connection with any investment program offered by Prio Wealth LP. The opinions expressed herein are not intended to provide personal investment advice, or tax or legal advice, and do not take into account the unique investment objectives and financial situation of the reader. Investments in securities, including common stocks and fixed income, either directly or through exchange-traded funds (“ETFs”) or open-ended mutual funds, involve the risk of loss that investors should be prepared to bear. Past performance may not be indicative of future results. The information in this report was obtained from various sources, but we cannot assure its accuracy. This document is not intended to provide personal investment advice and does not take into account the investment objectives and financial situation of every reader.