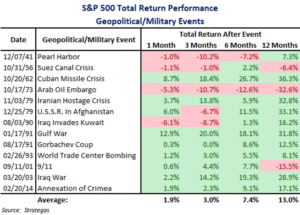

In light of recent stock market volatility caused by Russia’s recent invasion of Ukraine, we wanted to review how the stock market has performed over previous geopolitical/military events in world history going back to Pearl Harbor in 1941.

As the table below illustrates, despite higher initial volatility over the one- and three-month periods after such events, the S&P 500 performed well 12 months after all but three of these events. Additionally, it is worth noting that the three events that produced negative returns after 12 months were accompanied by recessions.

Despite an increasingly challenging investment environment, which now includes a war in Ukraine, economic sanctions on Russia, and higher oil prices, we continue to believe the overall investment backdrop is favorable. As such, we remain confident in our disciplined investment strategy for both fixed income and equities.

For fixed income, our defensive strategy targets short average duration and maturity, with an emphasis on high-quality bonds. In a rising interest rate environment, we believe capital preservation is paramount.

For equities, our strategy is to drive long-term performance by selecting stocks with good risk-reward profiles. We do this by investing in companies we believe are participating in the most compelling secular trends, who have good business models, stable or improving fundamentals, favorable ESG Risk Ratings, and reasonable valuations.

| This document has been prepared by Prio Wealth LP (“Prio Wealth”) for informational and educational purposes only and not as investment, legal or tax advice. This document reflects the opinions of Prio Wealth and it is based on information that we believe to be reliable at the time of publication. However, Prio Wealth does not guarantee the accuracy and completeness of any sourced data. Opinions expressed herein are not intended to provide personal advice and do not take into account the unique investment objectives and financial situation of the reader. This document is not an offer to sell or a solicitation of an offer to buy any security and does not constitute a representation as to the suitability or appropriateness of any security or financial product. Prio Wealth cautions the reader that investments in securities involve risks and that past results are not indicative of any future performance. |