If you are planning for charitable gifts, we want to help you give in the most efficient ways. It is important to consider how to give, what to give and when to give. Some financial advantages of charitable giving include an immediate reduction in estate size, a potential income tax deduction for lifetime gifts, and beneficial estate tax treatment for legacy gifts. We want to highlight a few strategies that may make sense for you: gift bunching, qualified charitable distributions from IRAs and legacy gifts using retirement accounts.

Gift bunching and qualified charitable distributions are more important now than they were a few years ago since so many Americans are not itemizing their tax deductions. Fewer people are itemizing because the standard deduction became higher, and limits were imposed on state and local tax deductions. Without itemizing deductions, you might not be receiving the maximum tax benefit for your charitable contributions.

Gift Bunching

You may want to consider making larger charitable contributions, less frequently. This involves making a large gift upfront, that would normally be made over multiple years, in a process known as “gift bunching”. You can give several years’ worth of charitable gifts to a donor-advised-fund (DAF) and then retain the discretion to make grants to your favorite charities over many years. To further maximize the value of your gift, you can use appreciated securities that you’ve held more than a year to fund the DAF. By doing this, you would receive credit for the full value of the stock and not owe taxes on the gain.

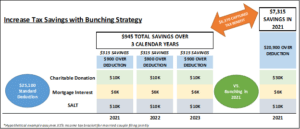

The example below describes the potential tax savings by gift bunching in year one versus over the course of three calendar years. This example couple is in the 35% income tax bracket with a modest mortgage and has an annual charitable giving goal of $10,000. If this couple bunches three years’ worth of gifts into year one, they would itemize their deductions and capture a tax benefit of $7,315 compared to annual gifting and uncertainty on reaching or exceeding the standard deduction.

Note that the IRS has a limit on how much individuals can deduct for charitable gifts each year. Appreciated stock gifts to a DAF are capped at 30% of adjusted gross income (AGI). While there are some rules that allow excessive gift amounts to be carried forward on an individual’s return – it applies only to those who continue to itemize deductions each year. Careful planning is required for individuals making charitable gifts larger than 30% of expected AGI.

Qualified Charitable Distributions

If you are age 70.5 or older, you can gift up to $100,000 to charity tax-free from your IRA each year using the qualified charitable contribution (QCD) method. The gift satisfies the minimum IRS distribution requirement and means that the distribution is not taxable income for the individual. Note that the money moves directly from the IRA to the charity for it to count as a tax-free transfer. Where gift bunching typically uses donor advised funds or private foundations, all qualified charitable distributions from IRAs must be made directly to a public charity. There is no need to itemize deductions to receive a tax benefit from the IRA gift. The tax-free transfer also lowers adjusted gross income, which may help to avoid the Medicare high-income surcharge and may also lower taxes due on Social Security benefits.

Legacy Gifting Using Retirement Accounts

If you want to include a charitable organization in your estate planning, consider using tax-deferred retirement accounts as the source of those gifts. Recent legislation has made these tax deferred assets less attractive for some beneficiaries since most non-spouse beneficiaries now must take the withdrawals over ten years. These withdrawals are taxed at ordinary income rates and will often push the beneficiaries into higher tax brackets. You can use the beneficiary designation of these retirement plans to fulfill your charitable bequests.

Conclusion

Many of our clients use a mix of the above strategies and others, such as charitable trusts and private foundations. As you are likely aware, there are potential tax changes on the table that could also impact these strategies. We can work with your team of advisors to help you navigate the changing tax legislation and evaluate your options for how to give, what to give and when to give. Please let us know if you’d like to discuss the best way to meet your charitable goals!

This document is for informational purposes only and should not be relied upon as an investment, tax or legal recommendation in connection with any investment program offered by Prio Wealth LP. The opinions expressed herein are not intended to provide personal investment advice, or tax or legal advice, and do not take into account the unique investment objectives and financial situation of the reader. Investments in securities, including common stocks and fixed income, either directly or through exchange-traded funds (“ETFs”) or open-ended mutual funds, involve the risk of loss that investors should be prepared to bear. Past performance may not be indicative of future results. The information in this report was obtained from various sources, but we cannot assure its accuracy. It should not be assumed that recommendations made in the future will be profitable.