Written by Prio Wealth’s Fixed Income Chief Investment Officer, Susan Mooney

In response to the COVID-19 Pandemic, both Federal Reserve policy and U.S. Government policy has been extraordinarily accommodative. In March 2020, the CARES Act was signed and Congress authorized $2.2 trillion in deficit spending. New programs were created to help support public and private entities such as states, municipalities, corporations, small business, and individuals. At the same time, the Federal Reserve reduced the Federal Funds Rate effectively to 0% and embarked on an unprecedented policy of buying U.S. Treasury, Mortgage, and Corporate debt to be held on its balance sheet. Much of the debt that was issued was, in turn, bought by the Federal Reserve (Quantitative Easing). The policy had the desired effect of stabilizing the debt markets, provide much needed aid, and avoid a serious recession. The Fed also prioritized its goals with full employment becoming the priority over a short-term rise in inflation.

This aggressive Federal Reserve policy, combined with massive government stimulus – and rising budget deficits – has led to concerns that a new form of economic policy termed “Modern Monetary Theory” or “MMT” could be adopted. MMT is controversial. Some economists believe it will not impact the level of interest rates; while others believe it will lead to a rise in inflation, a rise in interest rates, and a decline in the U.S. dollar.

Impact of Fed’s Current Policy

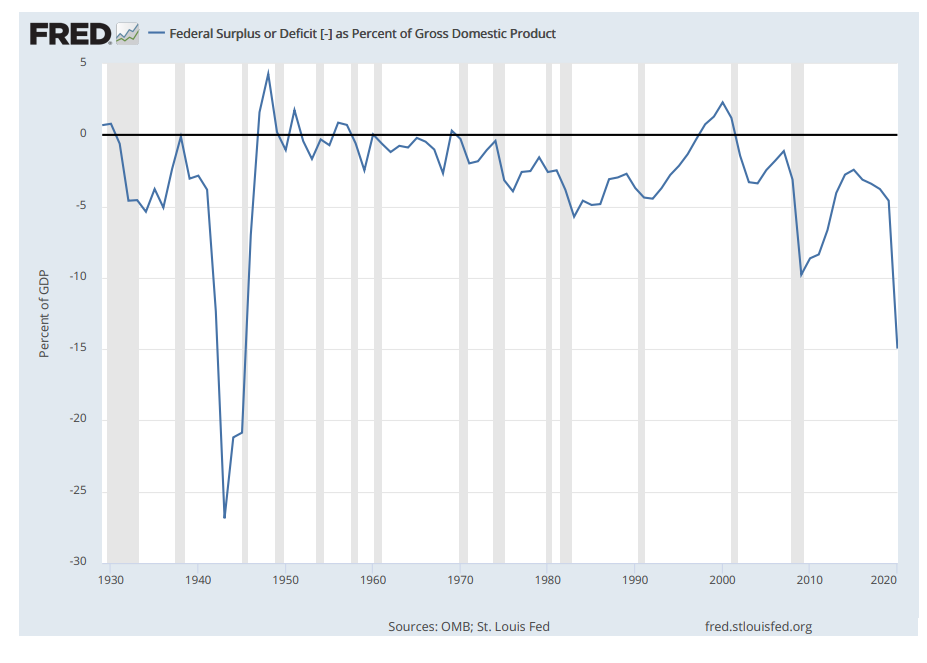

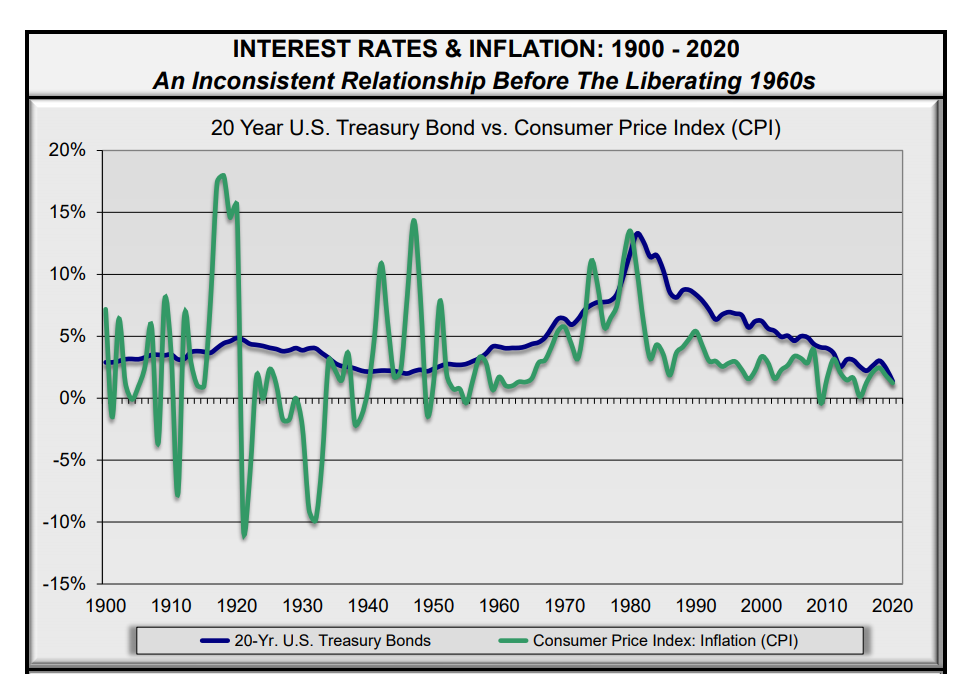

It is notable that the size of the deficit and the amount of outstanding debt as a percent of GDP has not been this high since the years after World War II. Additionally, interest rates have not been this low since that same time period. During the decade from 1940 to 1950 inflation reached a high of almost 15%, and yet interest rates remained below 3% for the whole decade.

Federal Budget Deficit Hasn’t Been This Wide Since the 1940’s – “Wartime” Spending

Similar to what happened in the 1940’s, the Fed instituted a policy of extraordinary stimulus to counter an extraordinary shock: enough to avoid a severe recession, cause inflation to increase, the stock market to react positively, all while maintaining low interest rates.

Source: Crestmont Research

Possible Impact of the Fed’s New Policy

With these thoughts in mind, we have fielded the following questions from clients, colleagues, and friends and family. Here are our current answers:

What will all of this debt lead to?

Traditional economic theory, and experience from the past 60 years, tells us increased deficits and debt should lead to higher inflation, higher interest rates, and a likely decline in the value of the dollar. A decline in the value of the dollar could lead to inflation – prices of imports would rise – and could cause further upward pressure on interest rates. Given these circumstances, higher interest rates would be expected in order to attract investors to buy U.S. Treasuries.

How does the debt get paid back?

It is unlikely the debt is completely paid back. If all of this stimulus does what it is intended to do, economic growth should increase significantly. GDP would increase, leading to higher tax revenues, a reduced need for issuing new debt, and a declining budget deficit. As outstanding debt matures, it is hoped the Treasury Department would not need to issue new debt to replace it.

Additionally, the Treasury Department could issue more of the debt in longer maturities – 20, 30 and even 50-year debt – to extend out the maturities far into the future, i.e. “Kick the can down the road.”

How much more debt can be issued?

The Biden Administration is hoping to pass a $1.9 trillion stimulus package. There are also plans for an additional $2 trillion in spending for infrastructure projects. Under a policy such as MMT, there is no limit as to how much debt can be issued. The Treasury Department can issue the debt, and the Fed, domestic, and foreign investors would buy it. The Fed could hold onto the securities until they mature – or they could sell some or all of it back into the market whenever they deemed conditions warrant it. With the Fed as a backstop, there would always be a buyer. Currently the Fed plans to hold rates low for another two years. The decision to taper purchases depends on how much unemployment declines and/or how much, or how quickly, long-term inflation expectations rise.

The plans for increased infrastructure spending are unknown at this time. It is possible that the Biden Administration plans would include new Public/Private partnerships in order to share the cost burden. It could also be funded with specific “infrastructure” debt similar to the Build America Bonds or a tax-advantaged bond that would appeal to individual investors.

What would make the Fed change this policy?

The Fed’s primary objective is to see the unemployment rate drop back to the low level seen pre-Pandemic (3.50%). If the unemployment rate fell below 4% and remained there for some time, and long-term inflation expectations rose, it would likely cause the Fed to end the current policy. Right now, it is willing to look past a short-term rise in inflation, such as higher food and energy costs prices. However, a rise in wages and housing would be considered long-term factors that would cause concern and would impact their decision.

How does this impact my fixed income investments?

Given the extraordinary economic stimulus in response to the Pandemic, we have been expecting to see a rise in long-term interest rates. Accordingly, our clients’ fixed income portfolios are positioned with this in mind. We continue to maintain a conservative approach by investing in high quality, liquid, and relatively short maturity bonds. Our key objectives of preserving capital and maintaining a reliable income stream have not changed.

If you wish to further discuss the Fed’s policy and your asset allocation strategy, please contact your Prio Wealth advisor. Our goal is to guide our clients and help them navigate the financial issues that may impact them and their family. Please feel welcome to introduce us to like-minded friends and family members that may benefit from our services.

This document is for informational purposes only and should not be relied upon as an investment, tax or legal recommendation in connection with any investment program offered by Prio Wealth LP. The opinions expressed herein are not intended to provide personal investment advice, or tax or legal advice, and do not take into account the unique investment objectives and financial situation of the reader. Investments in securities, including common stocks and fixed income, either directly or through exchange-traded funds (“ETFs”) or open-ended mutual funds, involve the risk of loss that investors should be prepared to bear. Past performance may not be indicative of future results. The information in this report was obtained from various sources, but we cannot assure its accuracy. This document is not intended to provide personal investment advice and does not take into account the investment objectives and financial situation of every reader.